APAC Chemical Expansion & Recruitment

Chemical Manufacturing Expansion in Singapore, China & APAC – Sourcing Shifts & Recruitment Solutions

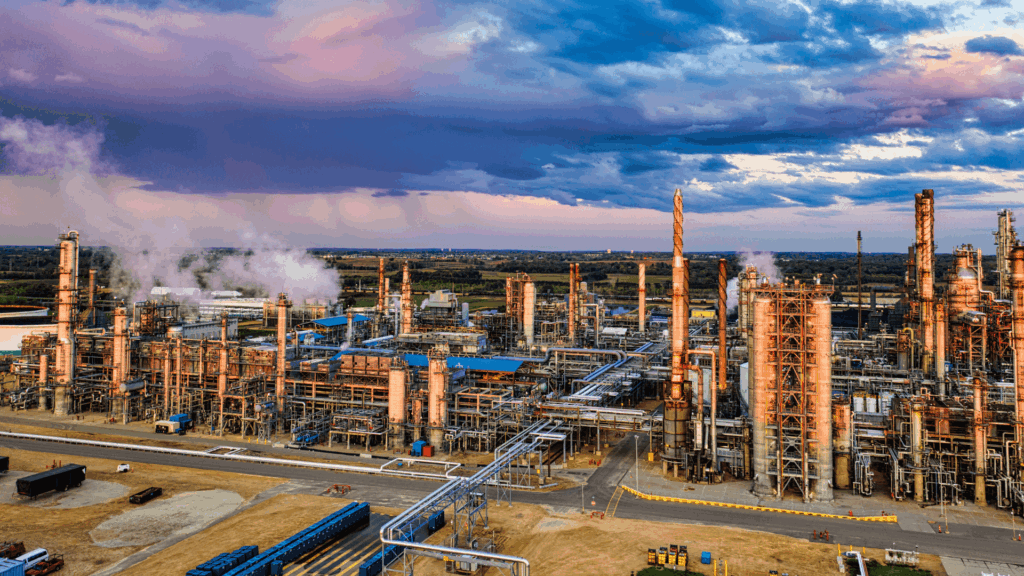

Growth Dynamics of Chemical Manufacturing in APAC

- China leads global growth: In 2024, China accounted for around 86 % of global chemical industry growth, with chemical production rising about 6.8 % compared to weaker performance elsewhere.

- APAC market scale: The chemicals market in APAC is projected to reach a total output of ~US$2.82 trillion in 2025, reflecting strong regional demand and capacity intensity.

- Singapore as a hub: Singapore’s Jurong Island has attracted over S$50 billion in chemical and energy investments and hosts more than 100 global chemical firms, thanks to integrated infrastructure and logistics advantages.

What’s Driving Expansion

- Demand concentration: Rapid industrialisation and consumer markets in China, India and Southeast Asia are boosting demand for base chemicals and specialty products.

- Cost & efficiency pull: Lower production and logistics costs in APAC compared to Western markets motivate firms to locate manufacturing close to end demand hubs.

- Government support & clustering: Jurong Island and China’s industrial clusters offer streamlined approvals, integrated utilities, and supply-chain efficiencies.

Impact on Raw-Material Sourcing

- Proximity to feedstocks: Locating production in Asia reduces dependence on long inbound supply chains, shortening lead times and improving inventory turns.

- Local sourcing networks: Firms increasingly source intermediate chemicals and feedstocks within APAC, creating regional supply ecosystems that improve resilience and cost efficiency.

- Strategic feedstock shifts: Investments in local cracking capacity – such as expansions in China – diminish reliance on imported naphtha and basic components.

Real Company Case Studies: Transition & Impact

ExxonMobil

- Exxon moved to expand high-value base stock facilities in Singapore while scaling up new ethylene cracker capacities in Huizhou, China – aligning production with regional demand clusters and optimising feedstock use.

- These moves reflect a strategy of balancing established hubs with newer capacity where cost and demand dynamics are stronger.

Clariant

- Swiss specialty chemical producer Clariant is expanding capacity in China, targeting a rise in China-based sales from 10 % to 14 % by 2027 and producing 70 % of products sold locally there.

- This localisation approach improves raw-material procurement flexibility and shortens supply routes to key customers.

Shell-CNOOC Joint Venture

- The CSPC Daya Bay petrochemical complex in Guangdong plans to add a third ethylene cracker with 1.6 million metric tons per year capacity and new specialty chemical facilities to serve domestic Asia demand.

- Increasing local capacity for base chemicals is part of sourcing strategy optimisation – feeding downstream plastics and specialty sectors efficiently.

Recruitment Challenges from APAC Expansion

Expansion creates a complex talent landscape with structural hiring challenges:

- Leadership with Regional & Technical Depth

Issue: Leaders must combine global chemical manufacturing experience with local APAC regulatory, cultural, sourcing and operational expertise.

Pain Point: Few candidates are fluent in both global standards and local execution across Singapore, China and ASEAN.

- Localisation vs Capability Gaps

Issue: Governments and joint ventures increasingly expect local executives, but domestically rooted leaders may lack exposure to multinational EHS, ESG, and capital project governance.

Pain Point: Companies struggle to bridge this capability gap during rapid expansions.

- Procurement & Sourcing Expertise Shortages

Issue: New sourcing strategies require regional category specialists who understand China and Southeast Asian supplier networks.

Pain Point: Traditional procurement teams often lack deep regional supplier negotiation and commodity risk skills.

- Technical & Engineering Talent Bottlenecks

Issue: Plant start-ups and expansions demand specialised process, reliability, automation and safety engineers.

Pain Point: Local labour markets can’t keep pace, especially at scale.

- Tight Singapore Skill Market

Issue: Singapore’s strong workforce is limited in size and expensive, competing across chemicals, energy and advanced manufacturing.

Pain Point: Filling niche, high-skill roles is costly and time-consuming.

- Retention & Internal Mobility Risks

Issue: Skilled APAC chemical professionals are highly marketable and often targeted by competitors.

Pain Point: Turnover disrupts continuity in essential roles.

Specialist Recruitment Partners as the Strategic Solution

Leveraging a qualified recruitment specialist or executive search partner offers structured advantages:

Targeted Access to Passive Candidates

Specialist recruiters maintain networks of senior executives with proven APAC experience, enabling discreet engagements and faster placements.

Benchmarking & Role Design

Recruitment partners can assist in role structuring, compensation benchmarking, and defining job profiles that align with local market expectations and global standards.

Regional Market Intelligence

Recruiters bring in-depth knowledge of candidate availability, compensation trends, and competitor movements – critical in tight markets like Singapore and China.

Sourcing Hard-to-Find Skills

Specialised recruitment firms focus on engineering, procurement, and plant-scale operational talent, often with cross-border mobility readiness.

Retention & Succession Support

Recruitment partners help with succession planning, counteroffer strategy and retention risk assessment for critical roles.

As chemical manufacturers navigate rapid expansion in Singapore, China, and APAC, strategic talent acquisition is critical. Companies that combine market intelligence, targeted talent mapping, and specialist recruitment support are better positioned to secure scarce procurement and technical expertise, optimise sourcing strategies, and drive cost-efficient, resilient operations across the region.

By Shane Harvey, Team Lead, Supply Chain, Skills Alliance